Gleneas Research Institute - info@gleneas.com , gleneas.com, youtube.com/@gleneas

Case studies

Please take a look at our work.

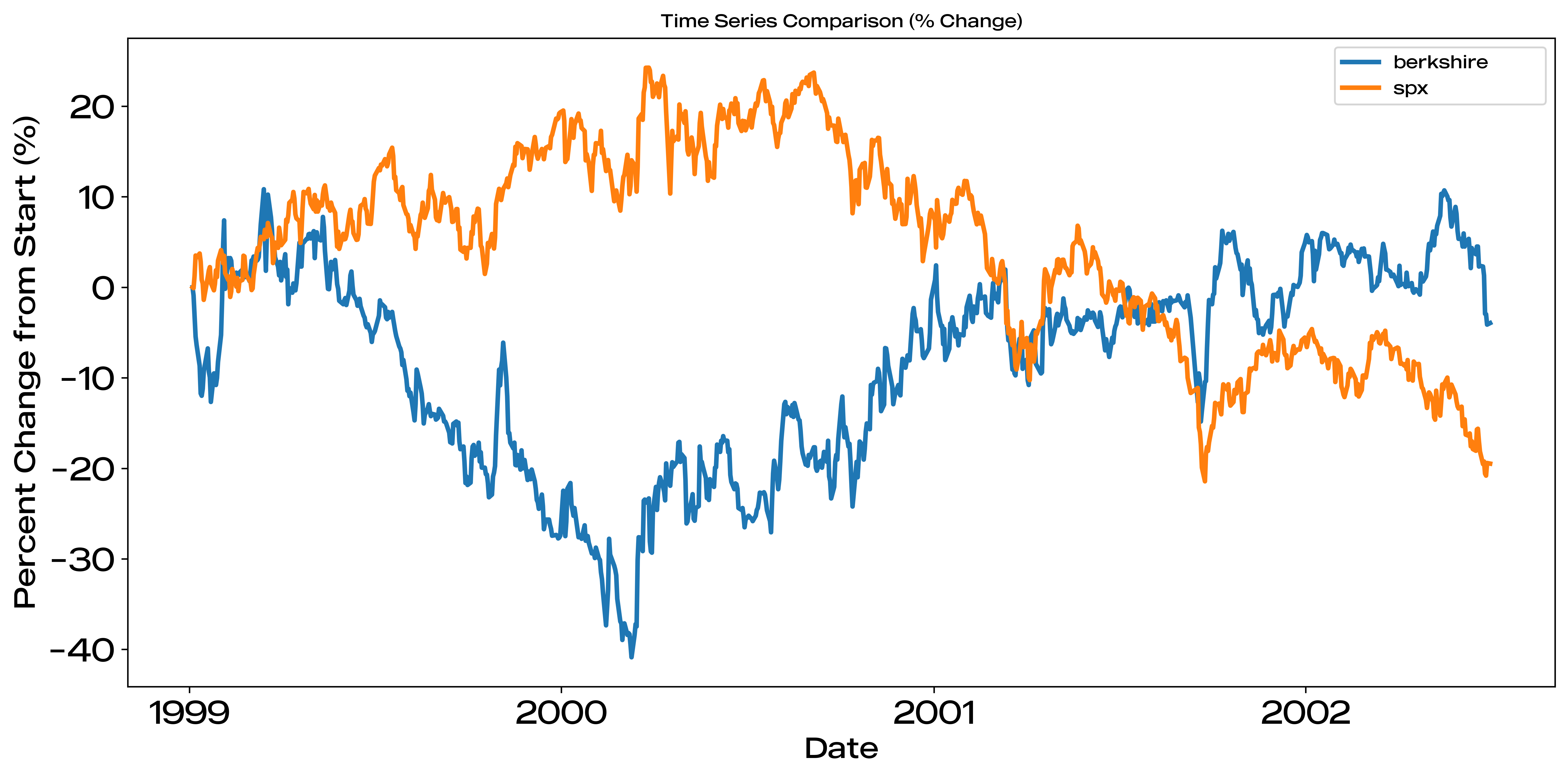

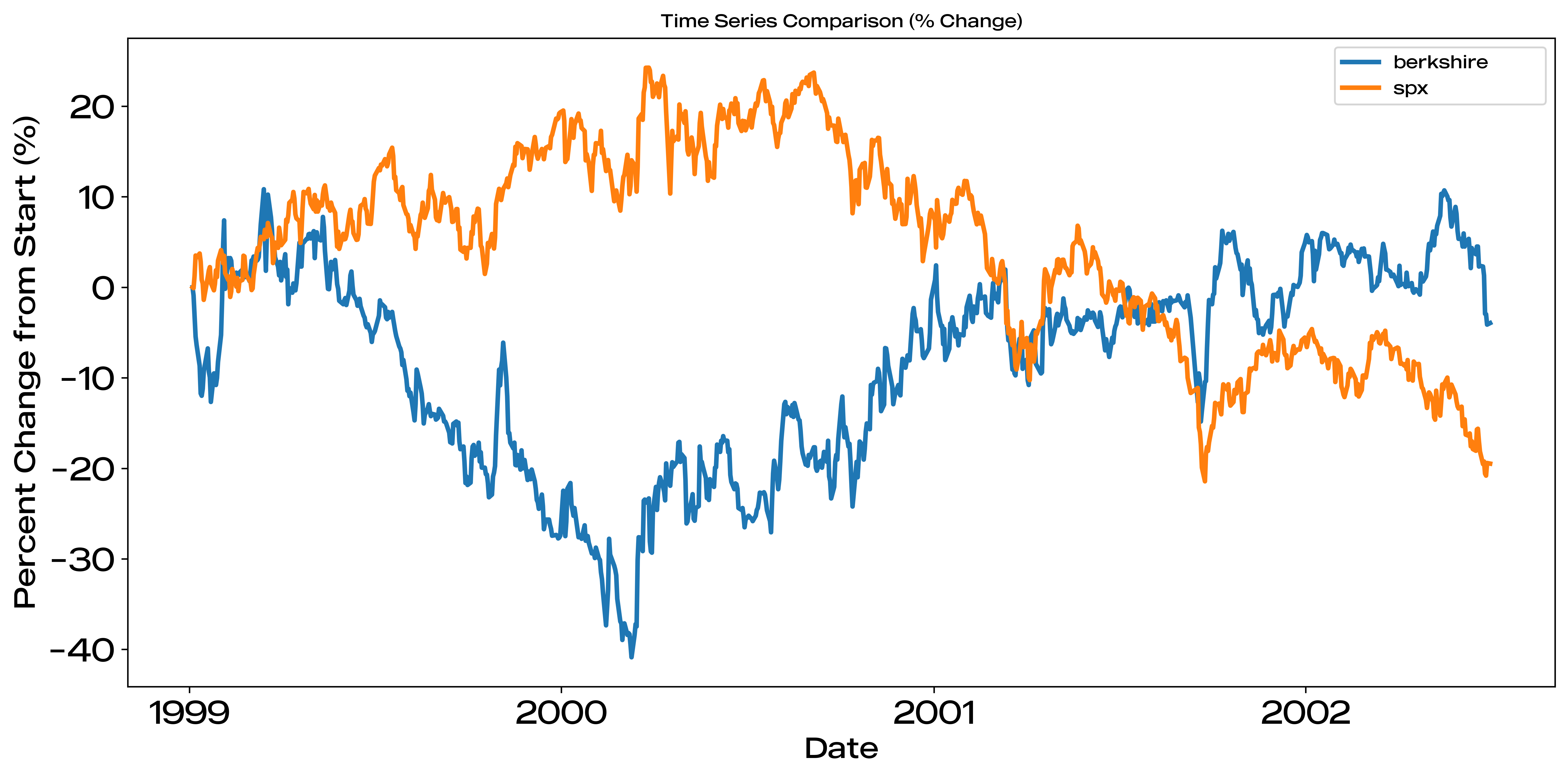

The Buffett gap widened once again.

07/21/2025

An absolutely super important fact is that right now, Warren Buffett is holding a record amount of cash.

At the end of the first quarter, Berkshire Hathaway’s cash position reached $347 billion, the highest level

in its history. This reflects a cautious approach in the current market environment, where valuations are

high and a small number of stocks are driving most of the gains. It’s not the first time Buffett has done this.

Before the dot-com bubble burst in the early 2000s, he also held back from investing heavily, which led to his

portfolio actually underperforming the S&P 500 during the final stretch of that rally. Yes, as you see here,

Buffett actually did worse than most investors at that time.

However after the bubble collapsed, the situation changed dramatically. While the broader market fell sharply, Buffett’s more conservative positioning began to outperform. The pattern now looks super similar. He is in fact again holding back, not finding many opportunities he considers reasonably priced. A cash position this large suggests he sees more risk than reward in the market at current levels. Since Buffett is holding record cash position, we're taking this very seriously into our analysis.

*Analysis by Gleneas

However after the bubble collapsed, the situation changed dramatically. While the broader market fell sharply, Buffett’s more conservative positioning began to outperform. The pattern now looks super similar. He is in fact again holding back, not finding many opportunities he considers reasonably priced. A cash position this large suggests he sees more risk than reward in the market at current levels. Since Buffett is holding record cash position, we're taking this very seriously into our analysis.

*Analysis by Gleneas